Hi guys,

I've decided to move my blog to a new site + blog (since Google allows blogs but not full on sites)

http://buildingarks.com/

Thanks for the readership, I'll be putting up new posts and informative pages there going forward. Please visit it

α | Relative Value

Trading, Investing, and life in New York

Saturday, May 31, 2014

Wednesday, February 12, 2014

Sell Rating: Bar Masa (at Columbus Circle NYC)

Just as this blog has outlined good investment ideas / trades I feel there is duty to also report bad experiences as well. Therefore, wanted to outline a sell rating on Bar Masa.

Went there Sat night dinner for 2 and found these issues:

Q.E.D.

Went there Sat night dinner for 2 and found these issues:

- No uni: this is big no no for Masa, like Five Guys running out of beef patties. I think it's commercially detrimental to even give the impression as a sushi place that the restaurant is not stocked up with freshest sushi. Poor management of reputational risk.

- Masa fatty tuna = normal lean tuna: First thing server says "we are known for our fatty tuna". We do a piece of fatty toro anyways. In fact the toro we get is actually lean tuna, not even medium fatty tuna; the color of the tuna is red like blood (not pink) and does not have the buttery / rich taste of fatty tuna. So in addition to no uni, they misrepresent their toro.

- Poor Skills Sushi chef: Indeed, I'm nitpicking now, but when the sushi came, the fish was overly cold and rice not warm and fresh. Duane Reade (a local drugstore) serves cold sushi for $6 for 12 pieces. The true indicator of skill is when the rice comes warm (body temp) and fish does not taste like it's from the freezer. This way flavor is balanced instead of tasting sushi that's equivalent to a block of ice.

Q.E.D.

Sunday, January 26, 2014

Titan CEO Responds to French Socialism

Below on the first link, you will find a great response by Titan CEO Maurice Taylor to the French government in saving a tire factory in France run by unions. The letter has some great comical value as well as giving an education on international labor laws. You have to love Mr. Taylor's honesty!

http://www.huffingtonpost.com/2013/02/20/titan-ceo-french-workers_n_2723996.html

http://online.wsj.com/news/articles/SB10001424127887323549204578316101127838118

Although not be apparent to most Americans, those who have worked at French international corporations realize that the labor rules are simply different in France. Employees in France are nearly impossible to lay-off and company benefits are astounding. The same structural issues which hurt GM and airlines could possibly be repeated in some French companies; maybe there are some good shorts ideas in Europe?

http://www.huffingtonpost.com/2013/02/20/titan-ceo-french-workers_n_2723996.html

http://online.wsj.com/news/articles/SB10001424127887323549204578316101127838118

Although not be apparent to most Americans, those who have worked at French international corporations realize that the labor rules are simply different in France. Employees in France are nearly impossible to lay-off and company benefits are astounding. The same structural issues which hurt GM and airlines could possibly be repeated in some French companies; maybe there are some good shorts ideas in Europe?

Tuesday, January 21, 2014

Lacking Substance: Doug Kass Poorly Constructs Short Berkshire Thesis

Seabreeze Capital Fund manager Doug Kass, while making a few good value calls last few years, went public with short thesis on Berkshire Hathaway (BRK/b, BRK/a), Warren Buffett's holding company. We'll examine why I think his arguments are weak

Last year, Buffett made a change-up by inviting a short-seller to his annual shareholders meeting. As luck would have it the short seller was Doug Kass, who publicly presented his arguments on shorting Berkshire. As you can guess, after reading Kass's thesis, I was not convinced at all.

Here's a list of the worst arguments ever made:

- "There will never be another Buffett, as the long-only value world has become increasingly competitive." What did you say Mr. Kass, you mean markets become smarter and more efficient over time? So insightful! (please note the sarcasm). While I do acknowledge that many more players have stepped into the value investing world and scooped up the low hanging fruit, please do not think that Buffett has been in decline; in fact, he was still at the top of the game as even a few years ago. As markets evolved, Buffett also has evolved as a learning machine, he and Munger would say. For example, in 2009, he sold 10-dated equity index options at the LOW of the market; so even while he himself says he doesn't time the market, Buffett sold insurance when premium was the most expensive. Also, note that the options he sold were uncollaterized, hence he understood the concept of CSA and collateral discounting before most banks moved to CSA / OIS discounting. To me, that trade still proved that Buffett is one of the best.

- "Investors will dump shares if Buffett is no longer at the helm." In the short term, the market is a voting machine, but in the long run the market is a weighing machine. His demise does not really impact the future cash flows of his companies

- "Growth has recently slowed." See counter-argument to point 1. As we shall see later, a recurring motif is that Kass has only 5 arguments, but somehow repeats a few of them to make 12 arguments. The only feasible point that he makes in the whole article is the fact that with so much cash, Buffett is a bit more limited in what he can invest in, since whatever he buys has to be large enough to move the needle for Berkshire.

- "Salad days for insurance are over." See counter to point 1. Otherwise, I do not understand much about insurance.

- "Outlook for low investment returns and poor economic growth will make it tough for Buffett." Environment of low investment returns? Kass could not have been more wrong (see Ray Dalio). 2013 was an incredibly risk-on year when US equities returned almost 30% and certain real estate markets (New York, Bay Area, etc) also went through a huge bull market.

- "Berkshire's premium valuation is byproduct of credit crisis and the company's perceived stability." First off, is there a premium on the valuation? I actually disagree vehemently that the company trades at a premium to its peers at 12x earnings. The P/E multiple needs to reflect the true risk of the business. Airlines need to trade at somewhere between 6x-8x earnings because the business is capital intensive, highly-levered, highly competitive, and laced with unpredictable costs. For Buffett, who can buy back his own stock at 1.2x book value, it seems the company is certainly not overvalued.

- "Sum of parts and relative EPS comparisons imply Berkshire is overvalued." See point 6. This argument is a complete clone of point 6.

- "As stock is sold in the marketplace, there could be an imbalance between buyers and sellers." And this imbalance is a bad thing? Incredibly poor argument. Again, in the short term, the market is a voting machine, but in the long run the market is a weighing machine. At a certain point, value investors will care to buy up the stock.

- "Some of Buffett's biggest investments seem vulnerable to post bubble crisis." Well then, Buffett might not have expected a large post bubble crisis.

- "Law of large numbers work against Berkshire." See counter-argument to point 3.

- "Weak disclosure at Berkshire." I would argue almost the exact opposite, that Buffett is very open about his mistakes, his positions, and his outlook for the upcoming year. His derivative positions are small in comparison to his other investments.

So there you have it. I am not going to lie, when I read this, I could not believe Doug Kass actually runs a fund; it would seem his Buffett short was more a publicity stunt than a well-crafted short thesis. Well, most of us in institutional investment management and trading obviously realize that capital is not always intelligently allocated...

Tuesday, January 14, 2014

Primer on Interest Rate Parity & Basis Swaps

Attached below is a cool primer on interest rate swaps, money market swaps and cross currency basis swaps. It explains some basic pricing principles and is a good read

Interest Rate Parity & Basis Swaps - Tuckman, Porfirio (Lehman Brothers)There will be some more discussion later on in a future post: as we will see that Libor / OIS basis swaps exploded in the 2008 Financial Crisis, and EUR/USD Cross currency swaps were extremely volatile from 2008 to 2011 (owing mainly to the fact that most European Banks do not have USD deposits and so need to fund their USD operations through the dealer market).

To get the most out of this paper, try working out the examples by hand and following the math provided by the paper.

Monday, January 6, 2014

Bringing Home the Birkin: Handbag Arbitrage

Former hairdresser demonstrates great trading prowess by traveling across Europe and executing an effective plan which enables him to buy "rare" handbags. He then re-sells these rare items later at a nice mark-up.

We've been covering some heavy mathematical and frankly intense topics, so instead, today we'll go through a very interesting story which is tangentially related to trading. In between trading, playing sports, poker, and other activities, I sometimes relax by reading books on other various subjects. On the heels of recommendations from friends, I picked up "Bringing Home the Birkin" by Michael Tonello and finished it in one weekend. Indeed, the target readers are usually heavy consumers of luxury items, mostly females, but it really has great educational value for everyone.The Synopsis

Michael Tonello moves to Europe to live the dream of working as a hairstylist abroad. One day, he is able to purchase a coveted Birkin Bag. If you grew up in the suburbs like me, you will be unable to guess correctly the value of these Birkin bags produced by Hermes. Some bags are roughly in the magnitude of a down payment on a house. Anyways, these hand bags are such in demand that Mike is able to repeatedly purchase them through various means (purchasing other items as to give the image of an important customer, bribe salespeople, use an associate who apparently is in with another employee, etc) and then re-sell them to others at nice mark-ups (in fact, one of the people he sold his bags to was an online re-seller). He ends up eventually amassing a small fortune doing what all good traders do, buy low / sell high.

Lessons Learned (the Juicy Analysis)

- Birkin Bags are not rare: one of Tonello's arguments is that in fact, no handbag is rare or "special" and that if one spends enough at a store, one is able to purchase a bag. The most common tactic of the author is to check-out with $10'000 worth of merchandise and then ask for a Birkin bag; if the store refuses, then Mike would simply not purchase the items. As you can imagine, usually a bag magically reappears in the back of the store. This goes against the whole impression set by Hermes and the media that there is a waiting list for these rare bags.

- Arbitrage requires EQ: common folks might envision the best traders are high-frequency programmers who sit along in front of a dark screen and type millions of lines of code. In fact, having healthy relationships with your counterparties and clients also enables you to get the best price or even get the "look" on the deal sometimes. I find this true in life, that one should never estimate the value of being liked, even in a world as objective as trading.

- Replicating a successful strategy > creating new strategies: the author basically ran around all of Europe doing the same thing and for the most part, was successful in buying a Birkin regardless of where he traveled to.

- Immediacy = Premium: arbitragers like Michael Tonello benefit because people who need something or need to transact should always pay a premium or sell at a discount to fair value. Why do people overpay for these bags? Because rich people need these items NOW, not in the 3 years required to be on the waiting list.

And By the Way...

Tonello's story sounds very attractive BUT before you go out arbitraging handbags, please consider this risk disclosure: a $15k Birkin bag to most people carry little real intrinsic value and therefore is effectively a greater fool asset. So by all means, if you try to scalp (buy and sell quickly) any type of greater fool asset, you better be in the moving business and not in the storing business; make sure also that you stick to a very short time horizon. |

| Mr Tonello in real-life |

Wednesday, January 1, 2014

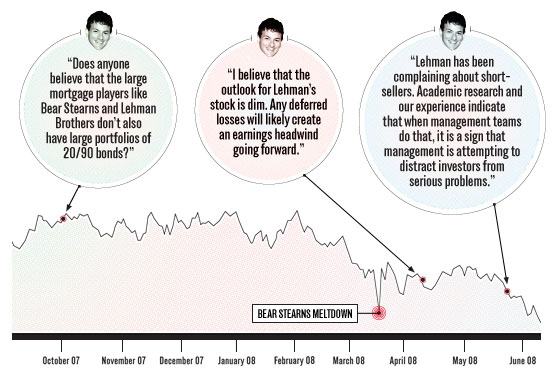

David Einhorn Testing Reflexivity of Markets

Happy New Year and welcome back from the holidays! At certain times (especially in crashes or bubbles), perception could become the reality; here is a real life instance illustrating the Theory of Reflexivity, which was preached by George Soros.

In May of 2008, Greenlight founder David Einhorn gave a famous and compelling thesis on shorting Lehman based on the fact that there were accounting inconsistencies, implying that Lehman should have marked down the value of certain illiquid assets much more than they had reported in recent financial statements. You can find the transcript here:David Einhorn - 2008 Ira Sohn Speech

Reflexivity

True, Einhorn made some insightful fundamental arguments against Lehman, but what is also interesting is the impact of such a news announcement. Banks are highly levered institutions which rely on liabilities (deposits, commercial paper, unsecured borrow) to fund assets (loans, investments). In a rising interest rate environment where the long-term rates > short-term rates, almost all banks to try earn the spread [long-term rates - short-term rates] by lending for long duration (long time periods) and borrowing for shorter time periods. However, the profit is not risk-free since these banks need to make sure they can roll their liabilities (once their borrow expires, they can go back to the market or to their counter parties to extend borrow for a new period).

Unfortunately, once the market loses confidence in any bank, it's essentially game over due to a "run on the bank", which is what resulted at Lehman Brothers. As bearish news (such as Einhorn's speech) hit the market, the stock started to trade lower and counterparties / other banks demanded a higher interest rate from Lehman in order to lend Lehman capital. As counterparties became less willing to lend to Lehman, their credit rating fell, causing the market to focus on their lack of liquidity, which in turn crushed the stock further. Then as credit agencies starting downgrading Lehman, less and less counterparties wanted to lend the bank money until finally Lehman cannot find enough players to lend it money via deposits, commercial paper, unsecured financing, etc. This vicious feedback loop and resulting downward spiral of frail companies was termed as "reflexivity" by George Soros in his book The Alchemy of Finance.

Sometimes, the price action of stocks which are caught in this downward spiral lend credibility to the adage in volatility trading "buy vol when it's low, sell vol when it's high, buy vol when it's ridiculously high." At the height of the panic, variance swaps on Lehman Brothers common stock (LEH) traded at 200%.

Einhorn Artificially Creates a Catalyst For His Own Trade

One important thing to note on the art of short selling is that you need a catalyst to drive the stock lower. For example, shorting stocks based solely on valuation (P/E and earnings quality) is risky because they can become even more ridiculously valued (see Nasdaq tech bubble in early 2000). So timing is everything. However, shorting an overvalued pharmaceutical name could be profitable right before an FDA announcement, etc. With Lehman, David Einhorn essentially created a catalyst to drive the stock lower by pointing out certain problems in the bank. Otherwise, Einhorn would still be correct on his fundamental analysis but might still lose money on his short due to bad timing. Today, we see many managers publicly talk up their book on CNBC to essentially monetize their influence on the market. The recent Herbalife (HLF) story is a very good example.

Subscribe to:

Posts (Atom)